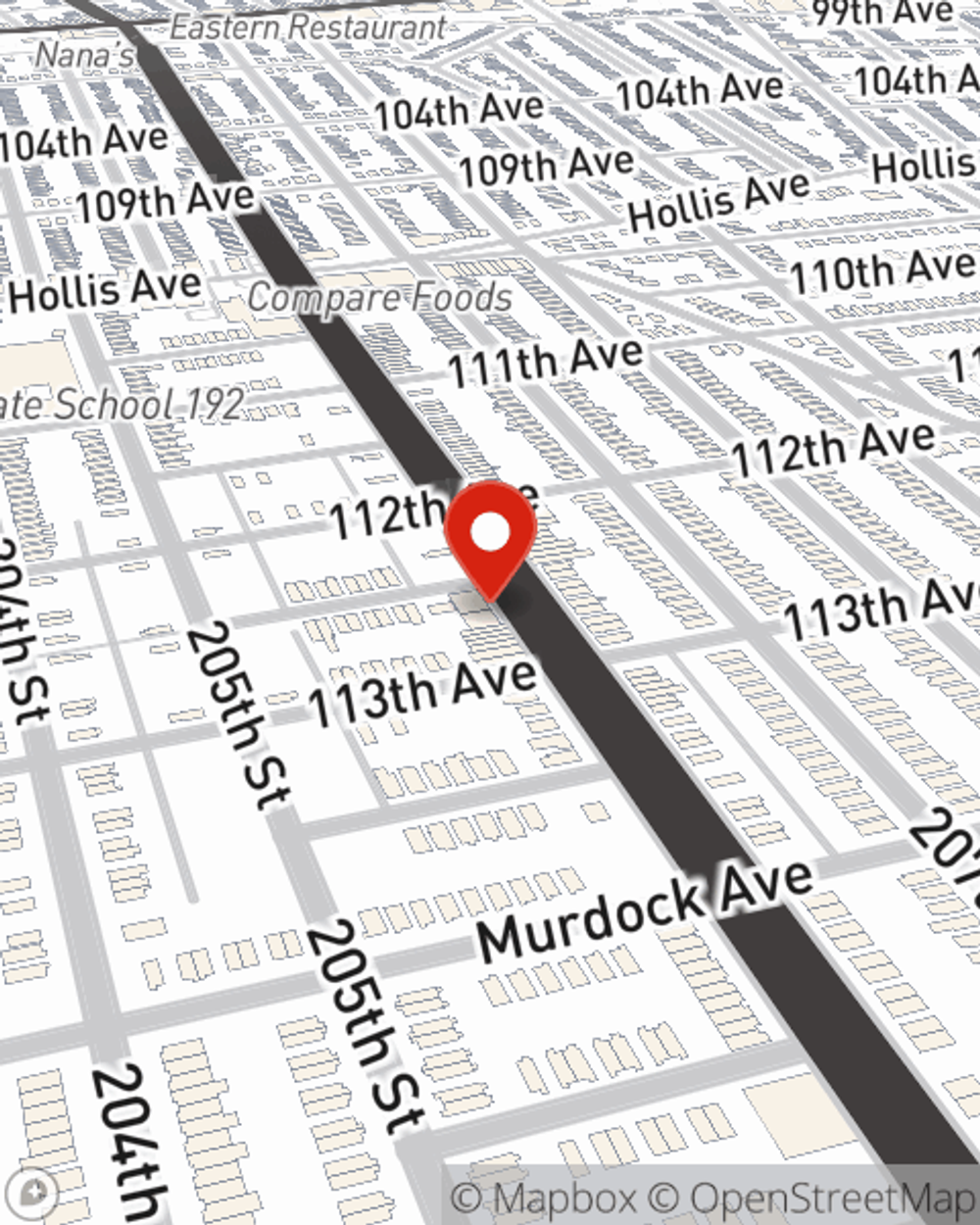

Renters Insurance in and around Queens Village

Get renters insurance in Queens Village

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It may feel like a lot to think through family events, your sand volleyball league, work, as well as deductibles and savings options for renters insurance. State Farm offers no-nonsense assistance and impressive coverage for your appliances, souvenirs and mementos in your rented apartment. When the unexpected happens, State Farm can help.

Get renters insurance in Queens Village

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

Renters often raise the question: Could renters insurance help you? Think for a moment about what it would cost to replace your possessions, or even just one high-cost item. With a State Farm renters policy in your corner, you won't waste time worrying about windstorms or tornadoes. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've left in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent John Hogan can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a value-driven provider that can help with all your renters insurance needs, visit State Farm agent John Hogan today.

Have More Questions About Renters Insurance?

Call John at (718) 776-0207 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.